Navigating Financing Options and Warranty Terms

Understanding vehicle financing and warranty terms helps owners make informed choices over the life of a car. This article outlines common financing structures, what different warranties cover, and how maintenance, inspections, and features such as connectivity or telematics can affect costs, efficiency, and resale value.

Understanding financing and warranty details is essential when acquiring a vehicle, whether new or used. Financing terms influence monthly payments, overall interest paid, and eligibility for certain protections, while warranty coverage defines which repairs and services are included during ownership. This guide explains common loan and lease structures, how warranty language is typically written, and how maintenance, inspections, and vehicle features such as connectivity and telematics can influence both short-term ownership costs and long-term resale value.

What financing options fit your needs?

Financing typically comes as dealer-arranged loans, direct loans from banks or credit unions, and captive finance from manufacturers. Lease agreements are an alternative that lowers monthly cost but limits mileage and affects long-term resale. Key elements to compare include APR, term length, down payment, and any fees or prepayment penalties. Credit score, loan-to-value ratio, and the vehicle’s age (new vs. used) will affect available rates and terms. For electric vehicles, incentives or special lender programs may change the effective cost, so ask lenders about EV rebates and rate adjustments.

How do warranty terms affect ownership?

Warranties range from manufacturer-backed bumper-to-bumper and powertrain warranties to aftermarket extended plans. Manufacturer warranties generally cover defects in materials and workmanship for set periods or mileage limits; powertrain coverage typically lasts longer. Extended warranties and service contracts vary in what they exclude—routine maintenance, detailing, wear items like tires, and emissions-related repairs may be handled differently. Read the fine print for deductibles, provider repair network rules, and whether diagnostics or telematics-based claims are permitted. Warranty terms can reduce unexpected repair costs but may have limitations tied to required service inspections and authorized dealers.

What should inspections, maintenance, and diagnostics include?

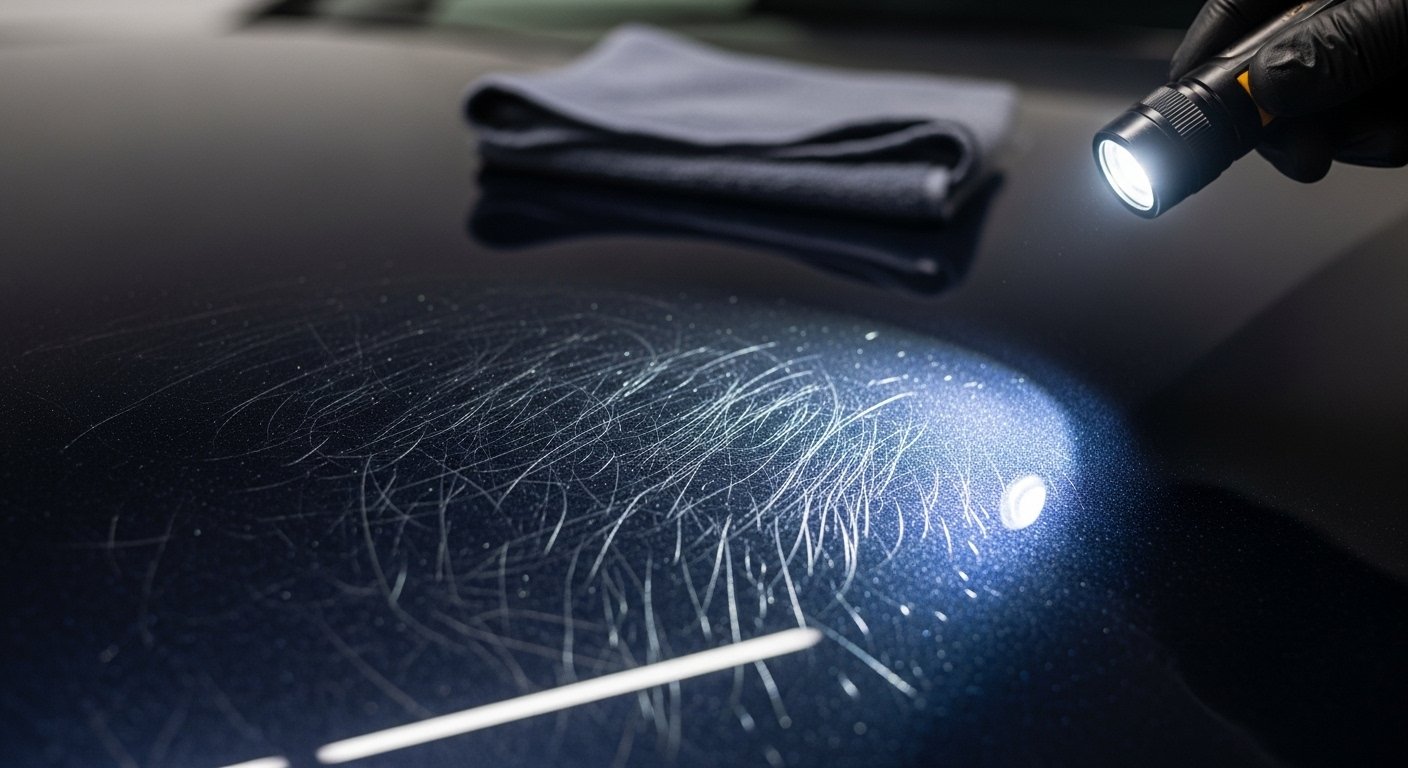

Regular maintenance and timely inspections preserve reliability and protect warranty eligibility. Common checklist items include fluids, brakes, tires, battery and charging system checks, emissions components, and periodic diagnostics for sensors and control modules. For electric vehicles, inspections emphasize battery health, charging ports, and software diagnostics rather than oil changes. Keep service records and detailed receipts for inspections and repairs; many warranties require proof of scheduled maintenance. Proper tire care, alignment, and detailing also help prevent wear-related claims and maintain safety and efficiency.

How do electric and charging considerations change choices?

Electric vehicles shift some ownership variables: charging access, battery degradation, and efficiency become central. Financing terms may reflect incentives for EVs, and warranty coverage often includes battery and high-voltage systems with separate terms. Consider local charging infrastructure and home charging installation costs when calculating total cost of ownership. Efficiency metrics affect range and operating cost, while emissions concerns are reduced with EVs but remain relevant if the vehicle has a gasoline-based range extender. Diagnostics and telematics systems in EVs can provide battery state of health and charging history, which influence resale value.

How do connectivity, telematics, safety, and resale relate?

Modern vehicles include telematics and connectivity features that record usage, service intervals, and sometimes crash data. These systems can streamline diagnostics and repair approvals but may also affect privacy and warranty claim processes if unauthorized modifications are detected. Safety features and connected services can improve resale by making a vehicle more attractive to buyers; however, software updates and subscription services tied to connectivity may have separate costs. Emissions systems and efficiency ratings remain important for combustion vehicles, and detailed service histories that include inspections and diagnostics typically support better resale outcomes.

Real-world costs and provider comparison

Costs for financing and warranties vary widely by credit profile, vehicle type, and the provider. Loan APRs, extended warranty fees, and deductible structures are all negotiable or dependent on qualification. Below is a comparison of commonly used lenders and extended warranty providers with representative cost estimates. These figures are estimates intended to illustrate typical ranges and should be verified directly with providers before making decisions.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Auto loan (new car) | Bank of America Auto Loans | APR range: ~3%–9% (varies by credit, term) |

| Auto loan (pre-owned) | Capital One Auto Finance | APR range: ~4%–12% (depends on vehicle age and credit) |

| Personal loan for auto | LightStream (Truist) | APR range: ~6%–14% (unsecured; depends on credit) |

| Captive finance | Ally Financial | APR and lease rates vary; dealer promotions may apply |

| Extended vehicle warranty (powertrain + limited) | Endurance | Typical annual cost: ~$500–$1,500 depending on coverage and vehicle age |

| Extended vehicle protection | CARCHEX (brokered plans) | Typical annual cost: ~$600–$2,000 depending on plan and mileage |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Conclusion

Choosing the right financing and warranty approach requires balancing monthly affordability, long-term cost, and protection against unexpected repairs. Regular maintenance, timely inspections, adherence to warranty requirements, and attention to diagnostics, tires, and safety features all play a role in preserving efficiency and resale value. For electric vehicles, charging considerations and battery coverage deserve special attention. Reviewing provider terms, comparing real offers, and keeping thorough service records can reduce ownership risk and clarify total cost over time.